Table of Content

Remember, your loan is not closed until your bank gives you a letter clearly stating it is. Just because you have paid your last EMI or full prepayment of outstanding amount, it does not imply loan closure. Almost every grown up working individual today has a history of paying educational loans, house loans, car loans, property loans and so on. Loans are meant to help people by providing them with a considerable amount of cash when required with the condition that they pay it on a monthly or yearly basis.

Any interest he/she was supposed to pay post preclosure will automatically be waived off on closing the loan. However, one must take into consideration the home loan preclosing charges that a bank may charge before preclosing. Sometimes, it would not make sense to preclose the loan as the charges levied on home loan preclosure exceed the amount that can be saved by paying off the loan in full. Preclosing a home loan simply means paying off your home loan way before the term of the mortgage is done. This can be done for various reasons such as refinancing, saving on interest, etc.

What is the procedure to close LIC Housing Loan?

Housing Loan is a stepping stone in realizing your dream home. LIC HFL offers wide variety of home loans which will fulfill your needs at one of the lowest interest rates available. Our home loans cater to all types of customer base viz., salaried, self-employed, professional, NRIs, etc. Our products are customizable according to your home loan eligibility. I have a laon with LIC HFL for 3 years and I am making a pre-payment to pay it all.

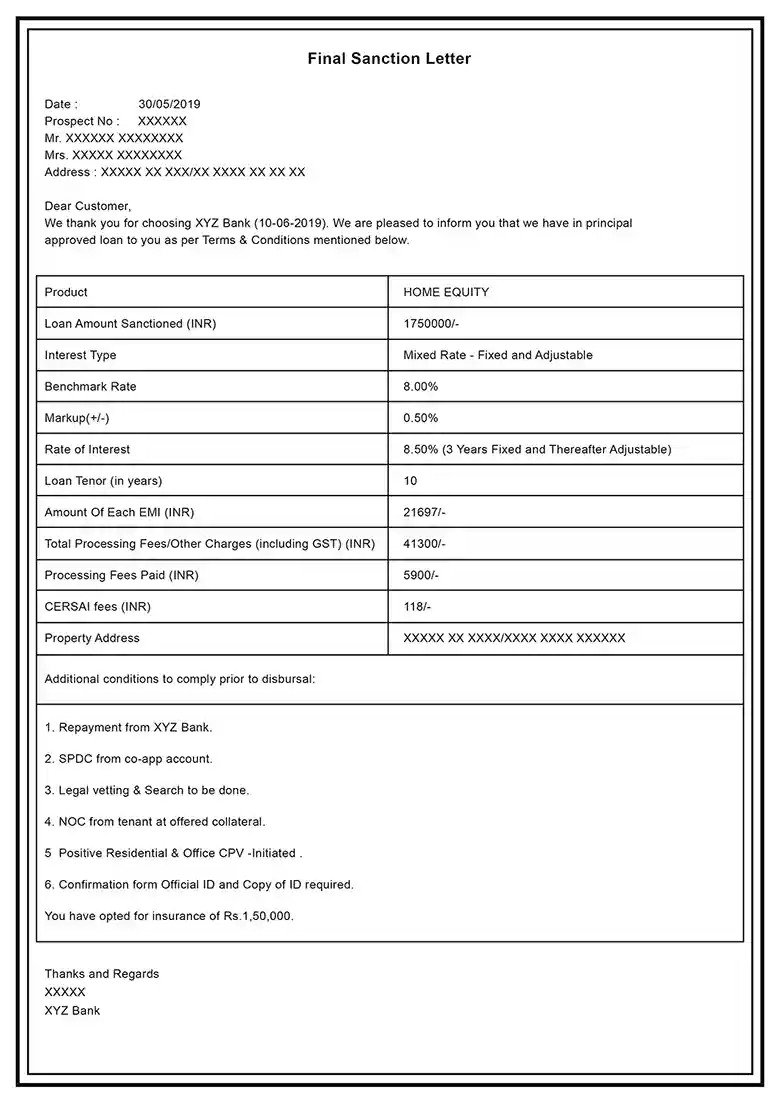

This varies according to the type of loan and the terms and conditions of the particular loan. You can learn more about how to apply for a loan and close a loan by reading this article. Also, learn how to write a loan closure letter by going through the sample loan closure letters. Since 2012, the Reserve Bank of India and National Housing Board have banned prepayment penalty on all floating interest rate home loans. However, you will have to pay a prepayment penalty if you have a fixed interest rate home loan.

Our Services

The actual tenure of my home loan with the account number 1623xxxx6536 ends in July. I was told that I would have a minimum of a 3% prepayment penalty as I am closing the loan prior to the completion of the loan tenure. Therefore, I authorise you to debit the said charges from my account.

Having your own house will for sure be an added advantage as it is easier to avail a loan in this scenario than a rented house. Only people above the age of 18 are usually considered eligible to apply for a loan. It’s adviseable to rating a legal approval certificate from the lawyer.

Can NBFC charge foreclosure charges?

Walking on subscription workplace that have a financial official and have now the newest lien got rid of. You must know one to without a beneficial lien got rid of, home financing pre-closure are partial. Given that payments are carried out into the pre-closure away from LIC HFL financial, you might be given the amazing possessions records. The good thing of your processes in order to pre-close LIC HFL home loan is that the data would be obtained in only 15 weeks. Because the proof income source, you will need to produce ITR processing, income slides and bank statements.

It may also be useful in case you plan to sell off the property. Home Improvement / renovation loans are available for existing as well as new customers. If you are looking for sample loan closure letters, you have come to the right place. Check out the following loan closure letter samples to understand the format well so that you can write your own letter without a doubt. If you have already applied for another loan, the chance of getting a loan is low as it is necessary that the loan applicant possesses the required credit amount. You should be able to show proof that you have a stable job or a permanent income that supports you and would help you pay back the loan.

It must be taken into account that financial institutions constantly charges prepayment punishment to possess closing financing in advance of tenure. Collecting the documents – While applying for the housing loan, original documents of the property must be handed over to the bank. These documents must be collected back from the bank on closure of the loan.

Online Premium Calculator, generate an instant illustration for Premium. We'll ensure you're the very first to know the moment rates change. A letter of abdication relinquishment must be written in order to surrender the property to the legal heir or nominee.

I hope before you started prepaying the amount, you had gone through all the formalities. When the bank disbursed your loan, it must have taken security cheques in case you defaulted on your EMI payments. Make sure you take these cheques back, once the loan is closed and destroy them to prevent misuse.

It is a clearance certificate, which describes that bank not has obligations or notice together with your property. They means that the files is actually cleaned by the lender after sorting away all the doubts. And in the event that the penalty on preclosure exceeds the interest saved on the loan, it becomes irrational to preclose the loan.

A special Housing Loan scheme for First Time Home Buyers by the Government of India. All families having income of Rs 3 lakh to Rs 18 lakh are eligible under this scheme provided they plan to purchase or construct their first pucca house. For all details and benefits under the scheme click here. For list of statutory towns eligible under the scheme visit the official website of National Housing Bank.

After closure of a home loan, it is the lender’s duty to hand over all the required documents back to the borrower. After all dues have been paid to the bank, the documents mentioned below must be collected from the lending institution. Once the payments are done towards the pre-closure of LIC HFL home loan, you will be given the original property documents. The best part of the procedure to pre-close LIC HFL home loan is that the documents can be received in just 15 days.

Also, the lump sum outflow of money can be a detriment to a person’s lifestyle and daily requirements. Preclosing a housing loan means that you lose a big chunk on money in one go. Home Loan is extended to individuals having pension benefit with loan tenure upto 80 years of age. Top Loan is additional loan over home loan provided to existing customers. NOC is a legal document that serves as proof of full repayment and closure of loan according to terms of lender.

It’s adviseable to has actually an in depth track of all of the mortgage payments. That processes is required to speed up your pre-closure process, you really need to start by record all the lender comments that basically reflect your loan EMI. Together with, continue an excellent photocopy regarding a request write or cheque if you are investing lump sum payment prepayments. Make sure you provide your complete loan account details and the reason why you are closing your loan account. You should also attach all the necessary documents according to the instructions given by the bank officials. I am Sudharshana Karthik, and I have a personal loan in my account in your bank.

No comments:

Post a Comment