Table of Content

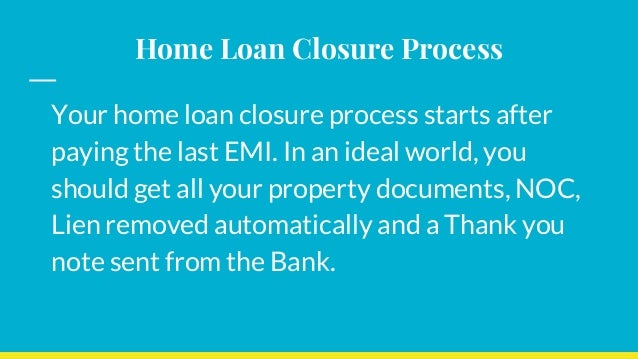

Taking a home loan is a long and tedious process, but so is closing it. This can be done either at the end of the loan tenure or before the specified tenure, if you have some extra funds at hand. To pre pay the loan, you must make sure you have excess funds to make the pre payment and for emergencies so that you are always financially secure. While submitting your documents to the bank, you must get an acknowledgment letter from the bank stating a list of documents being submitted. This is helpful while closing the loan, if a few documents get misplaced. Also, any change of address should be communicated to the bank so that all your documents are mailed to the correct address while loan closure.

It may also be useful in case you plan to sell off the property. Home Improvement / renovation loans are available for existing as well as new customers. If you are looking for sample loan closure letters, you have come to the right place. Check out the following loan closure letter samples to understand the format well so that you can write your own letter without a doubt. If you have already applied for another loan, the chance of getting a loan is low as it is necessary that the loan applicant possesses the required credit amount. You should be able to show proof that you have a stable job or a permanent income that supports you and would help you pay back the loan.

Prepayment fee

It’s adviseable to has actually an in depth track of all of the mortgage payments. That processes is required to speed up your pre-closure process, you really need to start by record all the lender comments that basically reflect your loan EMI. Together with, continue an excellent photocopy regarding a request write or cheque if you are investing lump sum payment prepayments. Make sure you provide your complete loan account details and the reason why you are closing your loan account. You should also attach all the necessary documents according to the instructions given by the bank officials. I am Sudharshana Karthik, and I have a personal loan in my account in your bank.

This varies according to the type of loan and the terms and conditions of the particular loan. You can learn more about how to apply for a loan and close a loan by reading this article. Also, learn how to write a loan closure letter by going through the sample loan closure letters. Since 2012, the Reserve Bank of India and National Housing Board have banned prepayment penalty on all floating interest rate home loans. However, you will have to pay a prepayment penalty if you have a fixed interest rate home loan.

Home Loan for Resident Indian

If you have net banking facilities for this Home Loan Account you can do the pre-payment easily, if not you can provide power of attorney to your brother. It would be good to cross check with any of the officials of LICHFL regarding the process of pre-payment. So once your home loan is closed, you must ensure that your bank updates this information at CIBIL. If not done, you may face problems in future financial transactions or loans. Top up Loan is additional loan over and above base home loan available for balance transfer cases to existing customers.

I am enclosing a copy of my Aadhaar Card, a copy of my PAN Card, Loan Sanction Documents, EMI Payment Receipts and a copy of my bank passbook as informed. I request you to kindly do the needful and close my home loan account as early as possible. In conclusion, prepaying a loan can help save some money. However, it must be done after careful calculation, as sometimes it may very well be that you are not saving any money.

Bankbazaar

Last 3 years income tax returns, P/L account, Balance sheet and all other necessary documents along with financials (For self-employed). PMAY is a special Housing Loan scheme for First Time Home Buyers by the Government of India. All families having income of Rs 3 lakh to Rs 18 lakh are eligible under this scheme. Home loans are available for individuals working abroad but willing to own a residential property in India. Basic, you will need to submit an application for an excellent pre-closing certification asking for LIC HFL. Home loans normally run for a long tenure and may also continue as much as fifteen to twenty years.

I have paid all my EMIs, and the loan tenure is complete. Kindly do the needful and let me know the further procedure of the closure of my personal loan. Please feel free to contact me in case of any queries. I am writing this letter to request you to close my personal loan account with the number 1526xxxxx4656.

What are the details I should include in the loan closure letter?

The newest court clearance certificate that is extracted from this new respected attorneys. Although it are an elective connection, this action will automate your pre-closing techniques. Collecting the No Objection Certificate – The No Objection Certificate or NOC is a statement by the bank acknowledging that you have paid all your dues. Your information is used only to complete the switching requested by you. We never share your personal information with others unless required by law.

Balance Transfer or Takeover of your existing home loan with other financial institute is also possible. Sorry, but you will not be able to close the entire home loan by repaying the first installment disbursed to you. You will need to repay the entire home loan amount as and when its disbursed to you. That’s what the rules say, however, you can approach your bank and ask them to consider you as a special case. Second, you can purchase a zero Objection Certification .

Personal loans can be used for various purposes, including weddings, travel purposes, renovations and so on. Balance Transfer or Takeover of existing home loan with other financial institute is also possible. For balance transfer of existing loans, customers need to have a good repayment track of their existing loan.

On receiving it, issue a cheque is favour of LICHL along with a request letter for preclosure of loan. You would be charged a prepayment penalty if it’s fixed rate home loan else no prepayment penalty is applied if it’s a floating rate home loan. A borrower can also preclose a housing loan to save up on interest. Closing off a loan before the term is due allows the borrower to evade a part of the interest.

If you remember, the loan officer or the bank officials would have mentioned the terms and conditions of the loan. This includes the time period in which you have to pay back your loan, foreclosure fee, a lien on the property you are taking a loan for, etc. For vehicle loans and personal loans, there might be a prepayment penalty of 1% to 5% of the outstanding balance before the pre-closure. Make sure you obtain a No Objection Certificate, which certifies that you do not have any pending payment dues. Do not forget to collect all the original documents that you had submitted when you applied for the loan.

Update your credit score – Once the loan has been closed, you need to request the bank to update your credit score. If you took out a loan against the value of your LIC policy, the balance you owe on that loan will be paid before you are given any money for surrender of your policy. If your loan is more than your surrender value, you may end up having to pay money to surrender your policy. Home Renovation loans are available for existing as well as new customers. Home Improvement loans are available for existing as well as new customers.

Remember, your loan is not closed until your bank gives you a letter clearly stating it is. Just because you have paid your last EMI or full prepayment of outstanding amount, it does not imply loan closure. Almost every grown up working individual today has a history of paying educational loans, house loans, car loans, property loans and so on. Loans are meant to help people by providing them with a considerable amount of cash when required with the condition that they pay it on a monthly or yearly basis.

No comments:

Post a Comment