Table of Content

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Programs, terms, and conditions are subject to change without notice. This form has detected unusual activity, which might be spam. Please contact support for help if you continue to see this message. The only other catch is that rent cannot come from family members.

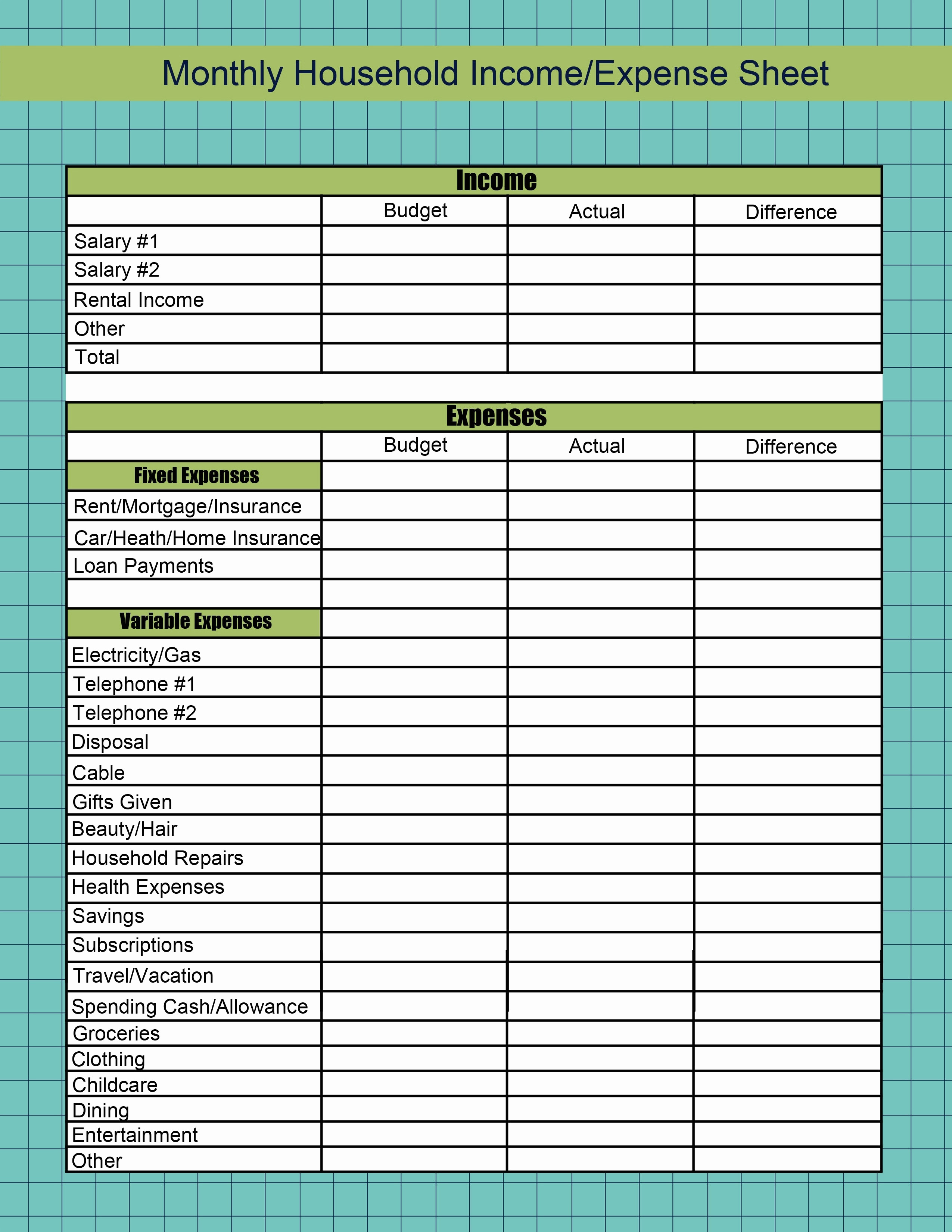

A rental apartment unit in this city costs from $395 to $1,850. Studio apartments average $670 and range from $420 to $1,015. A 1 bedroom apartment on the average costs $832 and ranges from $583 to $1,206. A 2 bedroom apartments averages $959 and ranges from $411 to $1,540. Three bedroom apartments average $998 and range from $460 to $1,350. 4 bedroom apartments average $1,144 and range from $395 to $1,850.

Best Rate Quick Quote!

These began with the HomePath program to give people some money to make repairs when they were buying a Fannie Mae-owned home. Talk with a VA lender to get a handle on what might be possible for your specific scenario. Both the Federal Housing Finance Agency and The U.S. Department of Housing and Urban Development realized this and will be increasing loan limits again effective January 1st, 2023. For more information about new rules and limitations for depreciation and expensing under the Tax Cuts and Jobs Actgo to the Tax Reformpage on IRS.gov. Apartment shoppers in this city are from many parts of Kansas.

How the home you purchase is classified can affect your taxes and the mortgage interest rate that you receive. The property you purchase can be classified as a primary residence, a secondary residence, or an investment property. Guidelines on this can vary by lender and can include things like cash reserve requirements, lease agreement conditions and more.

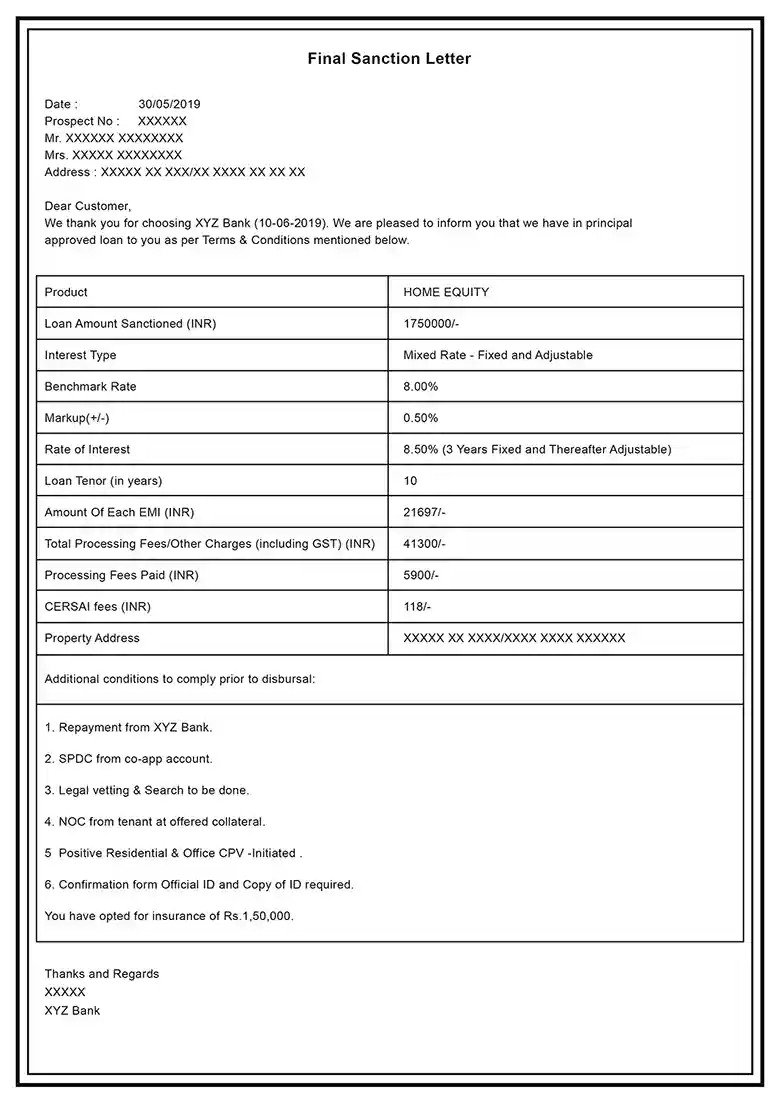

How Do Adjustable-Rate Mortgages Work Versus Fixed Rate Mortgages

The contact details listed below are missing from your profile and are required to proceed. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, pleaselet us know.

If your rental property is new and you don’t have an official history of being a landlord, lenders will only consider 75% of your rental income on your loan application. This is because they prefer to see a long history of steady income rather than a new income stream. So in the past 6 years, had I kept the home, it would’ve appreciated an additional $150K.

Can I rent out my primary residence?

These rules tell them if they can take the loss against other income. For detailed information about these rules, see Publication 925, Passive Activity and At-Risk Rules, and Publication 527. Residential rental property can include a single house, apartment, condominium, mobile home, vacation home or similar property.

The taxpayer can only deduct a percentage of these expenses in the year that they incur them. The Tangible Property Regulations - Frequently Asked Questions on IRS.gov have for more information about improvements. If you're a cash basis taxpayer, you can't deduct uncollected rents as an expense because you haven't included those rents in income. For information about repairs and improvements, and depreciation of most rental property, refer to Publication 527, Residential Rental Property . For additional information on depreciation, refer to Publication 946, How To Depreciate Property. The error we find, and why we felt it was important to create the additional training video, is in the math.

The rental property was out of service for an extended period,Schedule E will reflect the costs for renovation or rehabilitation as repair expenses. Additional documentation may be required to ensure that the expenses support a significant renovation that supports the amount of time that the rental property was out of service. If the property is not currently rented, lease agreements are not required and Form 1007 or Form 1025 may be used. If the income is derived from a property that is not the subject property, there are no restrictions on the property type. For example, rental income from a commercial property owned by the borrower is acceptable if the income otherwise meets all other requirements .

Taxpayers renting property can use more than one dwelling as a residence during the year. Security deposits – Don't include a security deposit in your income if you may be required to return it to the tenant at the end of the lease. If you keep part or all of the security deposit because the tenant breaks the lease by vacating the property early, include the amount you keep in your income in that year. To the extent the security deposit reimburses those expenses, don't include the amount in income if your practice isn't to deduct the cost of repairs as expenses. If a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you apply it to the last month's rent. Hopefully this gives a good picture on the difference between rental income analysis on a primary versus rental income analysis on an investment property.

Amounts paid to cancel a lease – If a tenant pays you to cancel a lease, this money is also rental income and is reported in the year you receive it. Many things in life are expensive, but finding a good place to live shouldn’t be one of them. Renting a subsidized or section 8 apartment is the best way to find affordable housing in Wichita. Searching for low income housing and no credit check apartments in Wichita, KS at Apartments.com is the first step toward finding a new home that you both love and can afford. Check out photos and find out information about neighborhoods, schools, nearby public transit, and more by clicking on any of these 198 Wichita income restricted apartments.

For an investment property, rental income can only be used to offset the PITIA of the subject property. Copies of the current lease agreement if the borrower can document a qualifying exception . Taxpayers use Form 8960, Net Investment Income Tax Individuals, Estates and Trusts, to figure the amount of this tax. If a taxpayer has a loss from rental real estate, they may have to reduce their loss or it may not be allowed. Taxpayers must refer to rules for personal use of a dwelling that they rent, at-risk rules and passive activity loss rules.

Additionally, if I turned it into a rental, how much rental income would I have brought in over those 6 years? The answer comes out to roughly $6,000 per year plus principal pay down of my mortgage, totaling about $60K of additional cash to me (forget about taxes for simplicity’s sake). If you’re thinking about or already have turned a primary residence into a rental, you might want to rethink that. Even if your property is allegedly in a “high appreciation” market, it still may not make financial sense to hold on to it. To understand why, it all comes down to a numbers game, especially taxes.

Guidelines on using rental income will vary by lender and other considerations. But you’ll typically need a proven track record as a landlord in order to count rental income from any current rental properties as effective income toward a new mortgage. The same is often true if you’re trying to purchase a multiunit property and count income from it. When buying another primary residence, VA loans allow the buyer to count up to 100% of the new rental income on the departing residence. In order to count the rental income, a 12-month lease must be provided, and most lenders even require proof of the first month’s rent or security deposit. In Scenario 3, the borrower currently owns their primary residence and has less than a year or property management experience.

Types of rental income

A current signed lease may be used to supplement a federal income tax return if the property was out of service for any time period in the prior year. Schedule E must support this by reflecting a reduced number of days in use and related repair costs. Form 1007 or Form 1025 must support the income reflected on the lease. If the borrower is not using any rental income from the subject property to qualify, the gross monthly rent must still be documented for lender reporting purposes. In Scenario 3, the borrower has no primary living expense (maybe they live rent-free with a parent or sibling) and no property management experience. As you might have guessed, this borrower would not be allowed to put rental income toward their mortgage payment.

When reviewing files in audit we have seen underwriters using the same method used on investment properties to credit the borrower with the rental income. But that is not the proper method, let me demonstrate the subtle difference that can make or break a files DTI. If you want to use income generated by the property you wish to finance, this is considered subject property income. The criteria for qualifying rental income will differ from income from the subject property than from other properties you own.